NIE number

The NIE is the Spanish tax identification number assigned to non-resident property owners in Spain, which is required for most formal registration and administrative procedures carried out in Spain.

NIE Number, the spanish tax identification

Who is it indended for?

The NIE is the Spanish tax identification number assigned to non-resident property owners in Spain, which is required for most formal registration and administrative procedures carried out in Spain.

A NIE number will be required when you Buy or sell a property in Spain, Inherit assets in Spain, Apply for a business permit, Apply for a mortgage or other type of loan, Open a bank account, Pay your taxes. Apply for a driving license in Spain, etc…. an many others

What does it include?

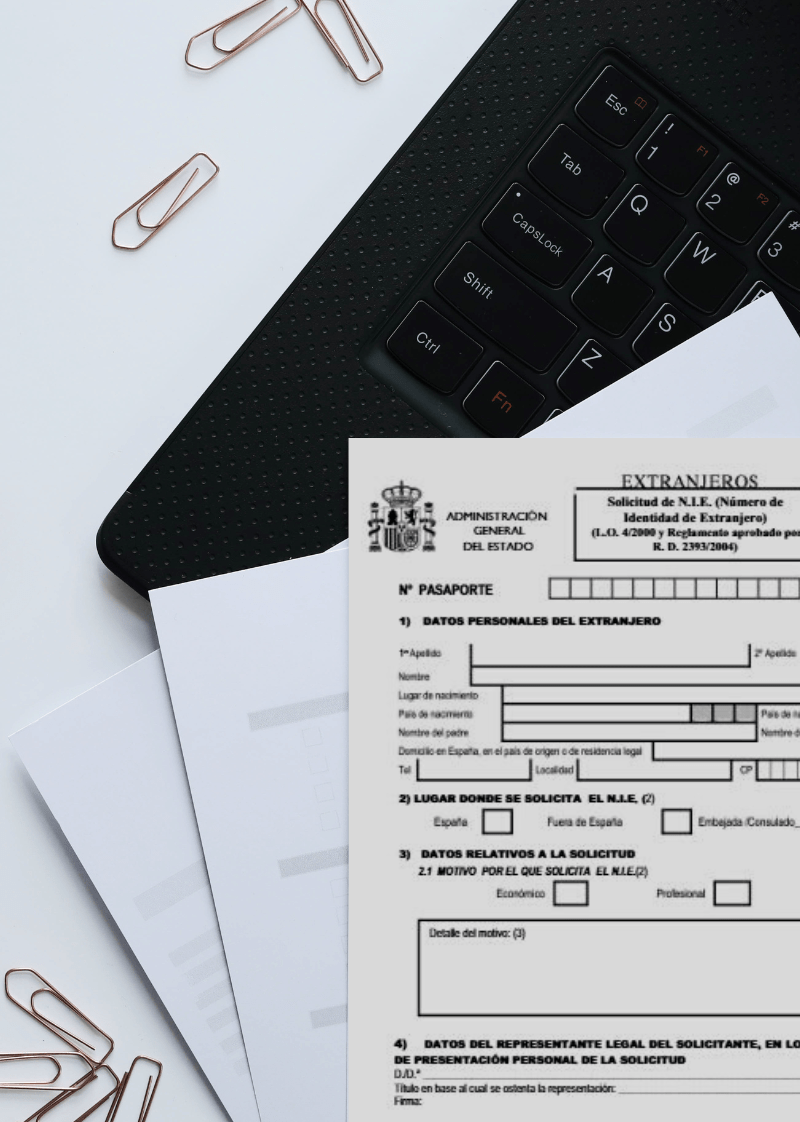

The NIE shall be applied to the Spanish police, you will be required to present the following documents:

- Your original passport plus 1 copy

- The NIE application form completed and signed

- 2 photographs

This service includes:

- Either accompanying you to apply for your NIE NUMBER (In Alicante, for example, people are advised to start queuing at 5.00 a.m. to get their NIE number, because each morning the office gives out numbers to the first 70 people in the queue. The rest have to return and queue again the next day.

- Obtaining and filling in the legal forms needed to apply for the NIE no.

- Receiving and sending you the NIE no. finally granted.

Book your appointment today

Contact us now to schedule your appointment.

C/ Patricio Pérez 21 - 1ºA

03181 Torrevieja (Alicante), Spain

We offer a fully conprehensive “one stop” service for non-resident clients for both new and resale property situated “ Costa Blanca “ , “ Costa Cálida“ and “ La Manga/Mar Menor

CONTACT

Email: lawyer@rodasconsulting.com

Phone: (0034) 96 570 96 56

Address:

C/ Patricio Pérez 21 – 1ºA

03181 Torrevieja (Alicante), Spain

Legal Notice – Legal Warning – Cookie Policy – 2023 @ Rodas Consulting SL